TITLE 7. BANKING AND SECURITIES

PART 1. FINANCE COMMISSION OF TEXAS

Subchapter A. Securities Activities and Subsidiaries

(a) A state-chartered bank may engage in private placement transactions by acting as broker and bringing together buyers and sellers of privately placed instruments. The term "private placement transactions" means:

(1) making recommendations regarding the terms and timing of the transaction;

(2) assisting in the preparation of the financing documents;

(3) contacting potential institutional investors;

(4) arranging meetings between the issuer and potential investors; and

(5) assisting in subsequent negotiations involving these parties.

Source: The provisions of this §3.1 adopted to be effective August 19, 1985, 10 TexReg 2542; amended to be effective May 17, 1996, 21 TexReg 3929; amended to be effective September 8, 2022, 47 TexReg 5327.

A state-chartered bank may provide investment and financial advisory services including professional asset management services and services as an adviser in connection with mergers, acquisitions, and divestitures. A state bank may also serve as a dealer-manager in connection with tender offers.

Source: The provisions of this §3.2 adopted to be effective August 19, 1985, 10 TexReg 2542.

(a) Securities activities permitted. Pursuant to Finance Code, §34.103(c), a state bank may establish or acquire a subsidiary that engages in securities activities; provided, however, that said subsidiary shall comply with all rules and regulations of the Securities and Exchange Commission and the State Securities Board applicable to registered brokers-dealers and investment advisors. The term "securities activities" means issuing, underwriting, selling, or distributing, or acting as agent or advisor in the issuing, underwriting, selling, or distributing of stocks, bonds, debentures, notes, or other securities.

(b) Capitalization. Any subsidiary engaged in securities activities pursuant to this regulation must comply with any applicable state and federal capital requirements including, but not limited to, those imposed by the Securities and Exchange Commission, the State Securities Board, or the National Association of Securities Dealers.

(c) Limitations. A state bank may not purchase, in its discretion as fiduciary or managing agent, any security underwritten, distributed, or issued by the bank´s securities subsidiary or any security issued by an investment company advised by the subsidiary unless authorized by applicable law.

(d) Notice. A state bank must, before or at the time of submitting a letter to the banking commissioner regarding a new subsidiary or new subsidiary activity as required by Finance Code, §34.103(e), submit to the banking commissioner any related filing or application made with the Federal Deposit Insurance Corporation or with a Federal Reserve Bank, including filings required under the provisions of 12 CFR Part 208 or Part 362, or any successor regulation.

Source: The provisions of this §3.3 adopted to be effective August 19, 1985, 10 TexReg 2542; amended to be effective May 17, 1996, 21 TexReg 3929; amended to be effective September 8, 2022, 47 TexReg 5327.

(a) Any state-chartered bank that is well-capitalized as defined by Section 38, Federal Deposit Insurance Act, 12 U.S.C. §1831o may file an application with the banking commissioner for permission to exercise, upon such conditions as may be prescribed by the banking commissioner, the following powers:

(1) to establish branches in foreign countries of dependencies or insular possessions of the United States for the furtherance of foreign commerce and to act as fiscal agent for any governmental entity;1

(2) to invest an amount not exceeding in the aggregate 10% of its paid-in capital stock and surplus in the stock of one or more banks or corporations chartered or incorporated under the laws of the United State or of any state thereof, and principally engaged in international or foreign banking, or banking in a dependency or insular possession of the United States either directly or indirectly; and

(3) to require and hold, directly or indirectly, stock or other evidences of ownership in one or more banks organized under the law of a foreign country or a dependency or insular possession of the United States and not engaged, directly or indirectly, in any activity in the United States except as, in the judgment of the banking commissioner, shall be incidental to the international or foreign business of such foreign bank; and to make loans or extensions of credit to or for the account of such bank in a manner and within limits prescribed by the banking commissioner.

(b) Such application shall specify the name and capital of the state bank filing it, the powers applied for, and the place or places where the banking or financial operations proposed are to be carried on. The banking commissioner shall have the power to approve or reject such application in whole or in part and shall also have the power from time to time to increase or decrease the number of places where such banking operations may be carried on.

(c) The investment limitation of Finance Code, §34.103(b), does not apply to an investment made pursuant to this section. The banking commissioner may approve any activity or investment authorized by this section subject to such restrictions as the banking commissioner deems advisable and consistent with safe and sound banking practices, and may require any investment pursuant to subsection (a)(2) or (a)(3) of this section to constitute a majority interest in the voting securities of the bank or corporation acquired.

Source: The provisions of this §3.4 adopted to be effective August 19, 1985, 10 TexReg 2543; amended to be effective July 13, 1994, 19 TexReg 5035; amended to be effective May 17, 1996, 21 TexReg 3929; amended to be effective March 9, 2006, 31 TexReg 1643; amended to be effective July 5, 2018, 43 TexReg 4451; amended to be effective September 8, 2022, 47 TexReg 5327.

A state-chartered bank may provide financial valuation and advisory services to its depositors or clients. The term "financial valuation and advisory services" means:

(1) the valuation of a company for purposes of acquisitions, mergers, and divestitures;

(2) fairness opinions in connection with tender offers, consolidations, or mergers;

(3) advice for management or for a bankruptcy court about the viability and capital adequacy of financially troubled companies and about the fairness of proposed bankruptcy reorganizations;

(4) valuation opinions for transactions in publicly held securities;

(5) valuations of the fair market value of employee stock ownership trusts;

(6) periodic valuation of stock of privately owned companies held in pension or profit-sharing plans, charitable trusts, or venture capital funds;

(7) valuation of a privately owned company, or of a large block of publicly owned securities;

(8) valuations, for estate tax and estate planning purposes, of a company´s common stock and other securities for recapitalization of a privately held company; and

(9) expert witness testimony in support of valuations.

Source: The provisions of this §3.5 adopted to be effective August 19, 1985, 10 TexReg 2543.

Subchapter B. General

(a) Definitions. The following words and terms, when used in this section shall have the following meanings unless the context clearly indicates otherwise.

(1) Call report--A report of condition and income in FFIEC form as required by 12 U.S.C. §1817, or a report of financial condition and results of operations of a state bank as mandated by the banking commissioner pursuant to the Finance Code, §31.108.

(2) FDIA--The Federal Deposit Insurance Act, 12 U.S.C. §1811 et seq.

(3) FDIC-The Federal Deposit Insurance Corporation.

(4) FFIEC-The Federal Financial Institutions Examination Council.

(5) State bank-A bank as defined by the Finance Code, §31.002(a)(50).

(b) Reporting requirements of FDIA regulated state banks. Each state bank which is subject to regulation under FDIA will be considered to have filed a copy of its call report with the banking commissioner if the state bank has filed its call report pursuant to FDIA and FFIEC guidelines and requirements.

(c) Reporting requirements for non-FDIA regulated entities. Each state bank not subject to subsection (b) of this section shall file four call reports annually with the banking commissioner. Such call reports must be filed with the banking commissioner no later than April 30, July 31, and October 31 of each year and by January 31 of the subsequent year, and shall be for the periods ending on March 31, June 30, September 30, and December 31, respectively, of the annual reporting year. The call reports required under this subsection must be in substantially the same form and contain substantially the same information as call reports filed by FDIA-regulated state banks in accordance with FDIA and FFIEC requirements pursuant to subsection (b) of this section. The call report forms, the instructions for completing the reports and the accompanying materials will be furnished to all state banks subject to this subsection, or may be obtained upon request from the Bank and Trust Division, Texas Department of Banking, 2601 North Lamar Boulevard, Austin, Texas 78705-4294. The banking commissioner may make such modifications and additions to call report form and contents under this subsection as considered necessary in the discretionary discharge of the banking commissioner´s duties, notwithstanding FDIA and FFIEC guidelines and requirements.

(d) Special call reports. In addition to the requirements of subsections (b) and (c) of this section, the banking commissioner may require a state bank to file and submit a special call report, in such form and manner and containing such information as may be requested, on dates fixed, whenever in the banking commissioner´s discretion the special call report is necessary in the performance of the banking commissioner´s supervisory duties related to the safety and soundness of the state bank. Special call reports must contain only such information as is specifically requested by the banking commissioner.

(e) Call report declarations and attestations. Each call report or special call report required to be filed under subsections (c) and (d) of this section must contain a declaration by the president, a vice president, the cashier, or by another officer designated by the board of directors of the state bank to make such declaration, that the report is true and correct to the best of such individual´s knowledge and belief. The correctness of the call report or special call report must also be attested by the signatures of at least two of the directors of the state bank other than the officer making the declaration. The declaration of the directors must state that the call report or special call report has been examined by them and is true and correct to the best of their knowledge and belief.

(f) Publication. Each state bank which is subject to regulation under FDIA will be considered to have publicly posted its call report if it has filed its call report pursuant to subsection (b) of this section. A state bank must publicly post or publish its call report in a newspaper or other media of general circulation if specifically directed to do so by the banking commissioner.

(g) Confidentiality. Pursuant to the Finance Code, §31.301, call reports filed under subsections (b) or (c) of this section are public information to the extent that such reports are considered public records under the FDIA, implementing federal regulations, and FFIEC guidelines, and may be published or otherwise disclosed to the public. Special call reports filed pursuant to subsection (d) of this section and non-public portions of call reports filed pursuant to subsections (b) or (c) of this section are confidential, subject only to such disclosure as may be permitted by the Finance Code, §§31.302-31.308, or by §3.111 of this title (relating to Confidential Information).

(h) Penalties for failure to file or for filing a report with false or misleading information. A state bank which fails to make, file, or submit a call report or a special call report or fails to timely file a call report or special call report as required by this section is subject to a penalty not exceeding $500 a day to be collected by the attorney general on behalf of the banking commissioner. Any state bank which makes, files, submits or publishes a false or misleading call report or special call report is subject to an enforcement action pursuant to the Finance Code, Chapter 35.

Source: The provisions of this §3.21 adopted to be effective May 17, 1996, 21 TexReg 3930; amended to be effective November 13, 1997, 22 TexReg 10949; amended to be effective March 9, 2006, 31 TexReg 1643; amended to be effective September 8, 2022, 47 TexReg 5327.

(a) Agreement in writing. A sale or lease agreement between a state bank and an officer, director, or principal shareholder of the bank or of an affiliate of the bank must be in writing. Existing verbal agreements must be reduced to writing and approved by the board.

(b) Terms of agreement. A sale or lease agreement between a state bank and an officer, director, or principal shareholder of the bank or of an affiliate of the bank must comply with applicable laws and regulations, be consistent with prudent and sound banking principles, and have terms and rates that are substantially equivalent to or more favorable to the bank than those prevailing at the time for comparable transactions with or involving nonaffiliated parties.

(c) Board action. All proposed transactions subject to Finance Code, §33.109, must be considered and voted upon by the board. Under Finance Code, §33.109(a), without the prior approval of a disinterested majority of the board, or the transaction at issue must be submitted for prior approval of the banking commissioner. For purposes of this section, approval of a disinterested majority of the board is obtained in the manner specified by the Texas Business Organizations Code, §21.418, with respect to a banking association, or §101.255, with respect to a limited banking association.

(d) Application for approval. If a sale or lease agreement requires the written approval of the banking commissioner prior to consummating, renewing, or extending a sale or lease agreement, a written request for approval must be submitted to the banking commissioner at least 60 days prior to the proposed effective date of the sale or lease agreement and must include the following information:

(1) a copy of the proposed sale or lease agreement;

(2) a complete description of the personal or real property to be sold or leased;

(3) a full disclosure of all existing transactions and/or relationships, whether direct or indirect, between the state bank and the parties involved;

(4) in the case of a lease agreement involving real property, a copy of the minutes of the board meeting reflecting an analysis of the information contained in this subsection;

(5) a certified copy of a board resolution approving the transaction and indicating those directors voting or abstaining, as the case may be, and either:

(A) evidence that the transaction received the approval of a disinterested majority of the board; or

(B) a statement explaining the reasons the approval of a disinterested majority of the board could not be obtained;

(6) copies of appropriate supporting documentation, including analysis of comparable terms and rates for the real or personal property to be sold or leased;

(7) in the case of a lease agreement, evidence demonstrating that the state bank will account for the lease in accordance with Financial Account Standards Board Account Standard Codification Topic 842, Leases; and

(8) other information which the banking commissioner may request.

(e) Records. A state bank shall maintain the originals of all sale or lease agreements with an officer, director, or principal shareholder of the bank or of an affiliate of the bank, which documents must be made available at all times to the Texas Department of Banking for examination and review. For purposes of this subsection, required documentation need not be retained beyond three years after the expiration of the sale or lease agreement to which the documentation pertains.

(f) Exemption. Finance Code §33.109, and this section do not apply to a transaction subject to and in compliance with the Federal Reserve Act, §23A and §23B (12 U.S.C. §371c and §371c-1), and implementing regulations applicable to nonmember insured state banks by virtue of the Federal Deposit Insurance Act, §18(j)(1) (12 U.S.C. §1828(j)(1)).

Source: The provisions of this §3.22 adopted to be effective November 22, 1996, 21 TexReg 11097; amended to be effective March 9, 2006, 31 TexReg 1643; amended to be effective May 10, 2007, 32 TexReg 2463; amended to be effective November 4, 2010, 35 TexReg 9694; amended to be effective September 8, 2022, 47 TexReg 5327.

(a) As used in this section, "trust services" mean services provided to the public as a fiduciary for hire or compensation, to hold or administer accounts established through a customer relationship involving the transfer of title to funds or property to the bank, including a fiduciary relationship in which the bank acts as trustee, executor, administrator, guardian, custodian, conservator, receiver, registrar of stocks and bonds, mortgage or indenture trustee, escrow agent, transfer agent, or investment advisor, except that "trust services" do not include customer services in which:

(1) the bank's duties as trustee or custodian are essentially custodial or ministerial in nature; and

(2) the bank may only invest customer funds:

(A) in its own time or savings deposits; or

(B) in other assets at the explicit direction of the customer, provided the bank does not exercise any investment discretion or provide any investment advice with respect to such other assets.

(b) A state bank that does not currently provide trust services and has not provided trust services for a period in excess of one year may not begin offering or providing trust services except upon compliance with this section and with any requirements imposed by the bank's primary federal regulator.

(c) A state bank described in subsection (b) of this section that intends to offer and provide trust services shall submit a notice to the banking commissioner describing the proposed trust services and the anticipated date for initiation of such services. In addition, the bank must submit:

(1) the bank's proposed business plan for providing trust services, including the policies and procedures the bank will employ to manage its fiduciary risk;

(2) sufficient biographical information on proposed trust management personnel to enable the banking commissioner to assess their qualifications;

(3) a description of the locations where the bank proposes to offer trust services and the manner in which such services will be provided at each location, including the extent to which fiduciary authority is proposed to be delegated to personnel at such location;

(4) if the bank's certificate of formation does not authorize the bank to exercise the trust powers necessary to provide the proposed trust services, an application for amendment of its certificate of formation pursuant to Finance Code, §32.101, accompanied by the filing fee required by §15.2 of this title (relating to Filing and Investigation Fees); and

(5) a copy of any filings made with the bank's primary federal regulator providing notice or seeking approval to offer trust services.

(d) Provided the bank's certificate of formation authorizes the bank to exercise trust powers sufficient to provide the proposed trust services, and subject to any conditions imposed by the banking commissioner and any required approval of the bank's primary federal regulator, the bank may begin offering and providing trust services on the 31st day after the date the banking commissioner receives the bank's notice under subsection (c) of this section unless the banking commissioner specifies an earlier or later date. The banking commissioner may extend the 30-day period on a determination that the bank's notice raises issues that require additional information or additional time for analysis. If the period is extended, or if the bank is amending its certificate of formation to authorize trust powers, the bank may not offer or provide trust services until it has received written approval of the banking commissioner.

Source: The provisions of this §3.23 adopted to be effective May 7, 2015, 40 TexReg 2409; amended to be effective July 5, 2018, 43 TexReg 4451.

A state bank shall notify the banking commissioner and submit the information required by 12 CFR Part 225, Subpart N, or Part 304, Subpart C, as applicable, or any successor regulation, regarding a computer-security incident that qualifies under such regulations as a notification incident, no later than the time the information is required to be submitted to the applicable federal regulatory agency.

Source: The provisions of this §3.24 adopted to be effective January 2, 2020, 44 TexReg 8227, amended to be effective September 8, 2022, 47 TexReg 5327.

(a) Pursuant to the Business and Commerce Code, §26.02, all financial institutions must conspicuously post notices informing borrowers of the requirements that certain loan agreements be in writing. Additionally, the finance commission is required to prescribe the language to be used in the notice. This section provides the language for the notice and clarifies the manner and location of the notice within the financial institutions so as to fully inform borrowers of the requirements.

(b) Each financial institution shall post in the public lobby of each of its offices other than off-premises electronic deposit facilities, the public notice set forth in this subsection.

NOTICE TO BORROWERS

CERTAIN LOAN AGREEMENTS

MUST BE IN WRITING

TEXAS LAW (Section 26.02, Business and Commerce Code) requires that all financial institutions conspicuously post notices summarizing requirements that loan agreements be in writing. You should know that:

• An agreement, promise, or commitment to loan more than $50,000 MUST BE IN WRITING AND SIGNED BY THE LENDER OR IT WILL BE UNENFORCEABLE.

• The written loan agreement will be the ONLY source of rights and obligations for agreements to lend more than $50,000.

• Oral agreements relating to loans over $50,000 are NOT EFFECTIVE either to establish a commitment to lend or to vary the terms of a written loan agreement.

As part of the documentation required for loans over $50,000, BORROWERS MUST BE PROVIDED AND MUST SIGN A NOTICE conspicuously stating that:

THIS WRITTEN LOAN AGREEMENT REPRESENTS THE FINAL AGREEMENT BETWEEN THE PARTIES AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS, OR SUBSEQUENT ORAL AGREEMENTS OF THE PARTIES.

THERE ARE NO UNWRITTEN ORAL AGREEMENTS BETWEEN THE PARTIES.

The notice set forth above, which must be signed by both the borrower and the financial institution, can be in a separate document or incorporated in one or more of the documents constituting the loan agreement. The notice must be in type that is boldfaced, capitalized, underlined or otherwise set out from surrounding written material so as to be conspicuous.

(c) The finance commission shall provide the preceding notice in dimensions and print which it determines is appropriate to fully inform borrowers of the requirements of the Business and Commerce Code, §26.02.

Source: The provisions of this §3.34 adopted to be effective February 14, 1990, 15 TexReg 485; amended to be effective March 9, 2006, 31 TexReg 1643.

(a) Purpose. The Finance Code, §59.110 requires financial institutions to imprint keys issued to safe deposit boxes after September 1, 1992, with the financial institution´s routing number. In addition, it requires a report to the Department of Public Safety if the routing number is altered or defaced so that the correct routing number is illegible. This section clarifies the requirements of this section.

(b) Definitions. The following words and terms, when used in this section, shall have the following meanings, unless the context clearly indicates otherwise.

(1) Financial institution-A bank, savings and loan association, savings bank, or other financial institution that has been assigned a routing number unique to that institution..

(2) Routing number-The number printed on the face of a check in fractional form or in nine-digit form that identifies a paying financial institution.

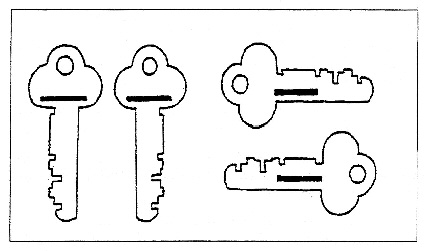

(c) Imprinting Requirements. A financial institution which has been issued a routing number shall imprint that routing number on safe deposit box keys on either the head of the key or the shank of the key if there is adequate room. The typical locations to be used are indicated in the following instructions and diagram. The imprint can be made anywhere on the key that has the required space available. It can be either on the head or on the shank of the key. When positioning the die on the key, be careful to place the die on the key where it will imprint on a flat surface and not in the area of the key cuts or on any of the shank ridges or grooves. Imprinting in these areas may interfere with the proper working of the key in the lock and may cause damage. In the event these standard areas for the location of the imprint are unavailable, either because of grooves on the key shank or the fact that the head of the key already has names and other numbers imprinted on it, then the financial institution may attach to the key a tag imprinted with the routing number. The tag used must be of such a nature as to be secure. Thus, a paper or cardboard tag or a tag affixed with string will not be acceptable. However, any other medium such as plastic or metal which can retain an imprint of a number shall be acceptable. The tag may be attached in any way to assure its affixation to the key. Typically, this will mean inserting the tag or a device to affix the tag through the hole in the head of the key normally used for placing keys on key chains. The tag method shall not be used if there is adequate room on the key itself for imprinting of the numbers.

There are four (4) standard areas for the location of the imprinted routing number. These include: the head of the key, the shank of the key, and either place on the reverse side of the key. The standard imprint areas are shown below:

(d) Branch Designation. A financial institution may, but is not required to, add a three-digit branch designation to its routing number. Thus, the main financial institution facility should receive the designation "001" and branch facilities should receive numbers consecutively beginning with "002" with successive numbers as needed. However, the financial institution may control the branch numbering system used provided that the financial institution must maintain a master list of branch designations used for this purpose. The master list should be maintained at the main office of the financial institution and shall include the following information: three-digit branch designation and address of facility. The financial institution then may imprint safe deposit box keys or tags with the routing number plus three-digit branch designation for full identification of the facility.

(e) Report of Defaced or Altered Key. Within ten days after an officer or employee of a financial institution observes that a key used to access a safe deposit box has had the routing number altered or defaced or the tag removed, a report shall be prepared of such incident. The report shall be on a form promulgated by the department in the form of the attached Exhibit A. The report should be submitted to the Department of Public Safety, attention: Criminal Law Enforcement, Box 4087, Austin, Texas 78773-0001. The report should be mailed no later than ten days after the incident. The financial institution should retain one copy of the incident report for a period of three years. Nothing in this section nor in the Finance Code, §59.110, shall require a financial institution to inspect routing numbers imprinted on a key or an attached tag to determine if the number has been altered or defaced.

REPORT OF DEFACED OR ALTERED ROUTING NUMBER ON SAFE DEPOSIT BOX KEY

Instructions: Complete the information below and submit the original report to Department of Public Safety, Attn: Criminal Law Enforcement, Box 4087, Austin, Texas 78773-0001, no later than 10 days after the defaced or altered key is used to access the box. Retain one copy for your files for a period of three years.

FINANCIAL INSTITUTION INFORMATION

Name of financial institution

____________________________________________

Address of safe deposit box facility

____________________________________________

____________________________________________

Name and title of contact person at facility

____________________________________________

____________________________________________

Area code and phone number of facility

____________________________________________

Routing number and branch designation (if any)

____________________________________________

INCIDENT INFORMATION

Customer name

____________________________________________

Date customer presented defaced or altered key

____________________________________________

Description of problem with key

____________________________________________

____________________________________________

____________________________________________

____________________________________________

Date of report:________________________________

(f) Applicability to Existing Keys. A financial Institution must imprint all safe deposit box keys issued on or after September 1, 1992. Additionally, the imprinting requirement applies to all keys issued prior to September 1, 1992. However, keys for boxes rented prior to September 1, 1992, need not be imprinted with the routing number unless and until a customer presents a safe deposit box key at a financial institution for access to a box. Nothing in this section or the Finance Code, §59.110, shall be construed to require a financial institution to provide notice to its safe deposit box customers or to otherwise require such customers to present their keys for imprinting. However, on the first date after September 1, 1992, that a customer presents a key which has not been imprinted, the financial institution shall imprint the key with the routing number as required by the Finance Code, §59.110.

(g) Effect of Change in Routing Number. In the event a financial institution´s routing number is changed as a result of a merger, acquisition, or other change, safe deposit box keys need not be replaced with a new routing number provided that the financial institution maintain a master list of the routing numbers used to imprint keys.

Source: The provisions of this §3.35 adopted to be effective September 18, 1992, 17 TexReg 6097; amended to be effective May 17, 1996, 21 TexReg 3932; amended to be effective March 9, 2006, 31 TexReg 1643.

(a) Authority. The assessment schedule contained in this section is made under the authority contained in the Finance Code, §31.003(a)(4) and §204.003(b).

(b) Definitions. The following words and terms, when used in this section, §3.37 of this title (relating to Calculation of Annual Assessment for Banks), or §3.38 of this title (relating to Calculation of Annual Assessment for Foreign Bank Branches and Agencies), shall have the following meanings, unless the context clearly indicates otherwise.

(1) Assessable assets--The sum of on-book assets and average off-book assets of a bank, foreign bank branch, or foreign bank agency.

(2) Average off-book assets--The average of the off-balance sheet items reported by a bank, foreign bank branch, or foreign bank agency in its most recent March 31st call report and the three immediately preceding call reports, as adjusted under subsection (c) of this section.

(3) Call report--The FFIEC quarterly, consolidated report of condition and income (including domestic and foreign subsidiaries) prepared and filed by a bank, foreign bank branch, or foreign bank agency under state and federal law.

(4) CAMELS composite rating--A bank's composite rating under the Uniform Financial Institutions Rating System (UFIRS), as described more fully in Supervisory Memorandum 1001, assigned by the department to a state bank in connection with its most recent examination by the department or by a federal bank regulatory agency

(5) FFIEC--The Federal Financial Institutions Examination Council.

(6) On-book assets--The total assets reported by a bank, foreign bank branch, or foreign bank agency on the balance sheet contained in its most recent March 31st call report, minus the outstanding balance of PPP loans included on "Schedule RC-M – Memoranda."

(7) PPP--The Paycheck Protection Program administered by the Small Business Administration.

(c) Calculation of average off-book assets. As a component of assessable assets, a bank, foreign bank branch, or foreign bank agency must calculate a four-quarter average of off-book assets specifically as instructed in the assessment form applicable to the institution, using the most recent March 31st call report and the three preceding call reports. In general, the bank, foreign bank branch, or foreign bank agency must sum all line items for which values are included on "Schedule RC-L-Off-Balance Sheet Items," which could result in assets of the institution, with the exception of:

(1) Amount of financial standby letter of credit conveyed to others;

(2) Amount of performance standby letter of credit conveyed to others;

(3) Participations in acceptances conveyed to others by the reporting bank, foreign bank branch, or foreign bank agency; and

(4) All line items related to derivative products as identified by the department.

(d) Annual assessment. Effective September 1 of each year, the department will establish the annual assessment for each bank, foreign bank branch, and foreign bank agency under subsections (f) and (g) of this section.

(1) The assessment for a bank is based on its assessable assets and calculated in the manner described in §3.37 of this title. Upon receipt of written notice from the department, the bank must pay the assessment to the department in quarterly installments by electronic payment/ACH debited effective September 15, December 15, March 15, and June 15 of each year, or by another method if directed to do so by the department.

(2) The assessment for a foreign bank branch or a foreign bank agency is based on its assessable assets and calculated in the manner described in §3.38 of this title. Upon receipt of a written invoice from the department, the foreign bank branch or foreign bank agency must pay the assessment to the department in quarterly installments, due on or before September 15, December 15, March 15, and June 15 of each year, or by another method if directed to do so by the department.

(3) A foreign bank representative office shall pay an annual assessment fee of $2,500 to cover the cost of examinations and all associated expenses unless the foreign bank also maintains a foreign bank branch or foreign bank agency in this state subject to assessment under paragraph (2) of this subsection. Upon receipt of a written invoice from the department, each foreign bank representative office to which this paragraph applies must pay its annual assessment to the department in a single installment, due on or before September 15 of each year. The department may require each foreign bank representative office to pay the annual assessment fee through electronic funds transfer.

(e) Review of assessment factors. The department will review all appropriations, revenue sources, expenditure patterns, and other revenues and costs related to examination and supervision of banks, foreign bank branches, foreign bank agencies, and present to the finance commission no less frequently than once each biennium such information and a calculation chart that sets forth the annual assessment factors.

(f) Interim adjustments.

(1) If the size, condition, or other characteristics of a bank, foreign bank branch or foreign bank agency change sufficiently during a year to cause the institution to fall into a different assessable asset group or to be subject to a new or different surcharge based on a change in the institution's CAMELS composite rating, the department will adjust the annual assessment to the appropriate amount beginning with the first billed quarterly installment after the change.

(2) In the event of an acquisition or merger involving a surviving state bank, foreign bank branch, or foreign bank agency, the department will adjust the annual assessment to reflect the result of the acquisition or merger beginning with the first billed quarterly installment after the consummation of the transaction. The asset group will be calculated on the basis of the combined assessable assets of the surviving institution.

(3) A financial institution that becomes subject to this section during a fiscal year as a result of conversion, merger, branching, or other change during a fiscal year must pay to the department an assessment beginning in the quarter of the conversion, merger, or other change to reflect only the quarter or quarters of the year in which the institution is subject to this section.

(4) Each bank, foreign bank branch, and foreign bank agency must pay to the department the full quarterly installment of the assessment for the next three-month period on the due date of the installment without proration for any reason.

(g) Adjustment of an installment. The banking commissioner may, after review and consideration of actual and projected revenues and expenditures in the current fiscal year, lower the aggregate amount of an installment and bill each institution subject to assessment a proportionally lower amount, without the prior approval of the finance commission.

(h) Specialty examination fees.

(1) Examinations of fiduciary activities and other special examinations and investigations, including but not limited to examinations of bank holding companies, interstate branches of state banks in Texas as host state, affiliates, and third-party contractors, are subject to a separate charge to cover the cost of time and expenses incurred in these examinations.

(2) The fee for an examination under this subsection will be calculated at a rate not to exceed $110 per examiner hour, to recoup the salary expense of examiners plus a proportionate share of department overhead allocable to the examination function. The banking commissioner in the exercise of discretion may lower the rate in connection with a specific examination or investigation for equitable reasons, without the prior approval of the finance commission.

(3) In connection with an examination under this subsection, the regulated entity or other legally responsible party shall pay to the department the examination fee set forth in paragraph (2) of this subsection, and shall also pay to the department an amount for actual travel expenses incurred by the examiners, including mileage, public transportation, food, and lodging.

(i) Special assessments. The finance commission may approve a special assessment to cover material expenditures, such as major facility repairs and improvements and other extraordinary expenses.

Source: The provisions of this §3.36 adopted to be effective January 5, 1996, 20 TexReg 10994; amended to be effective March 21, 1997, 22 TexReg 2608; amended to be effective September 9, 1999, 24 TexReg 6969; amended to be effective September 4, 2003, 28 TexReg 7347; amended to be effective January 2, 2014, 38 TexReg 9481; amended to be effective November 5, 2015, 40 TexReg 7620; amended to be effective July 5, 2018, 43 TexReg 4451; amended to be effective July 11, 2021, 46 TexReg 4023.

(a) Bank assessment calculation table. The annual assessment for a state bank is calculated as described in this section and paid as provided by §3.36 of this title (relating to Annual Assessments and Specialty Examination Fees), based on the values in the following table, as such values may be periodically adjusted in the manner provided by subsection (b) of this section. Certain terms used in this section and in the following table are defined in §3.36(b):

Figure: 7 TAC §3.37(a)

(b) Adjustments for inflation. In this section, "GDPIPD" means the Gross Domestic Product Implicit Price Deflator, published quarterly by the Bureau of Economic Analysis, United States Department of Commerce. The "annual GDPIPD factor" is equal to the percentage change in the GDPIPD index values published for the first quarter of the current year compared to the first quarter of the previous year (the March-to-March period immediately preceding the calculation date), rounded to a hundredth of a percent (two decimal places).

(1) Each September 1, the table in subsection (a) of this section, as most recently revised before such date pursuant to this subsection, may be revised as follows:

(A) each marginal assessment factor listed in Step 3 of the table is increased (or decreased) by an amount proportionate to the measure of inflation (or deflation) reflected in the annual GDPIPD factor, rounded to six decimal places;

(B) the base assessment amount listed in Step 4 for assessable asset group 1 is increased (or decreased) by an amount proportionate to the measure of inflation (or deflation) reflected in the annual GDPIPD factor, rounded to whole dollars; and

(C) each base assessment amount listed in Step 4 for assessable asset groups 2 through 14 is adjusted to an amount equal to the maximum annual assessment possible for the next lower assessable asset group (without surcharge), rounded to whole dollars. For example, the base assessment amount for assessable asset group 2 is equal to the annual assessment (without surcharge) calculated under assessable asset group 1 for a bank with exactly $10 million in assessable assets.

(2) If the table in subsection (a) of this section is revised for inflation (or deflation), then not later than August 1 of each year, the department shall calculate and prepare a revised table reflecting the inflation-adjusted values to be applied effective the following September 1, and shall provide each state bank with notice of and access to the revised table. At least once every four years, the department shall propose amendments to this section for the purpose of substituting a current revised table in subsection (a) of this section, and for such other purposes as may be appropriate.

Source: The provisions of this §3.37 adopted to be effective January 5, 1996, 20 TexReg 10994; amended to be effective September 9, 1999, 24 TexReg 6969; amended to be effective July 11, 2002, 27 TexReg 5961; amended to be effective September 4, 2003, 28 TexReg 7347; amended to be effective July 5, 2007, 32 TexReg 3977; amended to be effective January 3, 2008, 32 TexReg 9939; amended to be effective November 5, 2015, 40 TexReg 7620; amended to be effective January 5, 2017, 41 TexReg 10561; amended to be effective December 31, 2020, 45 TexReg 9413; amended to be effective September 8, 2022, 47 TexReg 5327; amended to be effective March 9, 2023, 48 TexReg 1291.

The annual assessment for a foreign bank branch or agency is calculated as described in §3.36 of this title (relating to Annual Assessments and Specialty Examination Fees), based on the values in the following table:

First determine the agency´s or branch´s assessable asset group, then:

| Steps | Assessment Calculation: | Assessable Asset Group | ||

| 1 | For assessable assets of at least (in thousands) | $0 | $70,000 | $250,000 |

| But not greater than (in thousands) | $70,000 | $250,000 | -- | |

| 2 | Take the total assessable assets over (in thousands) | $0 | $70,000 | $250,000 |

| 3 | And multiply by this factor: | 0.00 | 0.05 | 0.01 |

| 4 | For the assessment, add this result to the base assessment amount of: | $10,000 | $10,000 | $19,000 |

Source: The provisions of this §3.38 adopted to be effective January 5, 1996, 20 TexReg 10994; amended to be effective September 9, 1999, 24 TexReg 6969.

Subchapter C. Foreign Bank Branches, Agencies and Representative Offices5

The following words and terms, when used in this subchapter, have the following meanings unless the context clearly indicates otherwise:

(1) Foreign bank branch or Texas branch --A Texas state branch proposed to be established or established and maintained by a foreign bank pursuant to the Finance Code, Chapter 204.

(2) Foreign bank agency or Texas agency--A Texas state agency proposed to be established or established and maintained by a foreign bank pursuant to the Finance Code, Chapter 204.

(3) Foreign bank representative office or Texas representative office--A Texas representative office proposed to be established or established and maintained by a foreign bank pursuant to the Finance Code, Chapter 204.

Source: The provisions of this §3.40 adopted to be effective March 9, 2006, 31 TexReg 1643.

(a) Application. To establish a Texas branch or agency, a foreign bank shall file with the banking commissioner an application for a license on the form prescribed by the commissioner. The application must:

(1) be in English and be signed, sworn to and acknowledged by an officer of the foreign bank;

(2) be fully completed and provide the information and include as attachments the documentation specified in the application form and the department's instructions, including the information and documentation required under the Finance Code, §204.101, and such other information and documentation as the banking commissioner reasonably requests; and

(3) be accompanied by the application fees and applicable deposits required by §15.2 of this title (relating to Filing Fees and Cost Deposits).

(b) If a foreign bank has established an initial Texas branch or agency, the banking commissioner may waive one or more of the informational requirements of the license application form with respect to any additional Texas branches or agencies the foreign bank seeks to establish. However, payment of the application fee provided for in §15.2 of this title may not be waived.

(c) Notices. A foreign bank that maintains a Texas branch or agency shall file with the banking commissioner:

(1) the notices and applications required under the Finance Code, Chapter 204, including §§204.005, 204.008, 204.107 - 204.109 and 204.115;

(2) if the foreign bank intends to establish a Texas representative office, a notice at least thirty days before the effective date of the opening of the office that states or includes:

(A) a copy of any filings with other state or federal agencies in connection with the establishment of the office;

(B) the street and mailing address and the telephone and fax numbers for the office;

(C) the name and qualifications of the manager or officer in charge of the office and contact information for that person;

(D) the Texas branch or agency or other office to which the Texas representative office will report and contact information for the responsible officer at that office;

(E) a list of the activities in which the office will engage; and

(F) a copy of the filed document evidencing compliance with the Finance Code, §201.102;

(G) a list of activities to be engaged in at the office; and

(H) date on which the foreign bank plans to commence business at the office; and

(3) if the foreign bank intends to establish, relocate or close a loan production office, the notice required under §3.91 of this title (relating to Loan Production Offices).

(d) Reports. A foreign bank that maintains a Texas branch or agency shall file with the banking commissioner the following reports:

(1) the reports required under the Finance Code, Chapter 204, including §204.002, and, to the extent applicable, §§3.51-3.62 of this title (relating to Pledge and Maintenance of Assets by Foreign Bank Licensed to Maintain Texas State Branch or Agency);

(2) an annual report, within 120 days after the close of the foreign bank's fiscal year, that is in English or accompanied by an English translation and is signed, sworn to and acknowledged by one of the authorized officers, managers, or agents transacting business in this state, and that includes:

(A) a copy of the most recent audited financial statement of the foreign bank, expressed in the currency of the country of its incorporation or organization and in United States currency;

(B) a letter from the certified public accountant, chartered accountant, or similar independent service provider of the foreign bank certifying that the statements have been prepared in accordance with generally accepted accounting principles of the home country of the foreign bank;

(C) a general description of the foreign bank's business activities;

(D) the location and a general description of the foreign bank's headquarters office if the office has been relocated since the last annual report filed under this paragraph;

(E) disclosure of all material legal proceedings in which the foreign bank or any of its subsidiaries has been named as a defendant that could result in a material adverse impact on the financial condition of the foreign bank, and a description of such potential impact, quantified to the extent feasible;

(F) a listing of the foreign bank's:

(i) board of directors;

(ii) executive officers; and

(iii) overseas operations by office; and

(G) a copy of the foreign bank's organizational chart by functional department.

Source: The provisions of this §3.41 adopted to be effective March 9, 2006, 31 TexReg 1643.

A foreign bank branch or agency shall maintain the following records in English, or accompanied by an English translation, at its authorized location and make the records available for examination by the department or as otherwise requested by the banking commissioner:

(1) the records required under the Finance Code, Chapter 204, including §204.002, and, to the extent applicable, §3.60 and §3.61 of this title (relating to Pledge and Maintenance of Assets by Foreign Bank Licensed to Maintain Texas State Branch or Agency);

(2) separate accounting records relating to its assets and liabilities and, if available, its income and expenses resulting from the branch's or agency's operations in this state;

(3) records relating to all filings or permits required by federal regulators;

(4) records of all credit balances, including:

(A) a list of each credit balance;

(B) the contractual terms applicable to each credit balance; and

(C) the contractual terms specifying the completion of the transactions to which the credit balance relates;

(5) records listing all representative offices, loan production offices, or other subsidiaries maintained in this state by the foreign bank branch or agency or by the foreign bank that controls the branch or agency; and

(6) such other records that the banking commissioner may require.

Source: The provisions of this §3.42 adopted to be effective September 13, 1996, 21 TexReg 8451; amended to be effective March 9, 2006, 31 TexReg 1643.

(a) A foreign bank branch or agency may not receive deposits except as specifically authorized under the Finance Code, §204.105(b). A foreign bank branch or agency may receive funds from a person and maintain a credit balance in accordance with the Finance Code, §204.105(b).

(b) A credit balance includes:

(1) proceeds of loans to customers where such proceeds are not immediately disbursed;

(2) loan payments from customers;

(3) funds delivered by customers to settle letters of credit accounts with the branch or agency prior to settlement date;

(4) proceeds of bills of exchange, drafts, notes, acceptances, and other obligations for the payment of money arising out of the purchase and sale (but not discount) of same;

(5) funds received from customers to cover currency transactions or as the result of currency transactions consummated by the branch or agency on behalf of customers;

(6) funds received for transmission to another place;

(7) fund arising out of repurchase agreements, federal funds transactions, and other types of purchase, sale, or borrowing transactions in interbank markets;

(8) proceeds of collections made for customers´ accounts;

(9) accounts due to other offices or entities controlled by or under common control with the foreign bank corporation that owns the foreign bank branch or agency; or

(10) funds received from customers as security for a loan.

(c) Credit balances may not remain in the foreign bank branch or agency after the completion of all transactions to which they relate.7

Source: The provisions of this §3.43 adopted to be effective September 13, 1996, 21 TexReg 8452; amended to be effective March 9, 2006, 31 TexReg 1643; amended to be effective July 5, 2018, 43 TexReg 4451.

(a) General. A foreign bank may establish a representative office in this state whether or not the foreign bank is authorized to maintain a Texas branch or agency.

(b) Applicability. This section applies only to a foreign bank that does not maintain a Texas branch or agency. A foreign bank that maintains a Texas branch or agency is not subject to this section and may establish a representative office by providing the notice required under §3.41(c) of this title (relating to Applications, Notices and Reports Related to Foreign Bank Branches and Agencies).

(c) Statement of registration. To establish a representative office in this state, a foreign bank shall file with the banking commissioner a statement of registration on the form prescribed by the department. The statement of registration must:

(1) be in English and be signed, sworn to and acknowledged by an officer of the foreign bank;

(2) be fully completed and provide the information and include as attachments the documentation specified in the registration form and the department's instructions, including the information and documentation required under the Finance Code, §204.201, and such other information and documentation as the banking commissioner reasonably requests; and

(3) be accompanied by the registration fee established in §15.2(b) of this title (relating to Filing and Investigation Fees).

(d) Commencement of operations. A foreign bank may establish its representative office upon receipt of written confirmation from the banking commissioner that the statement of registration is complete and all required fees have been paid.

(e) Separate statement of registration required. A statement of registration must be filed for each representative office a foreign bank establishes in this state. If a foreign bank has established an initial representative office in accordance with this section, the banking commissioner may waive one or more of the informational requirements of the statement of registration form with respect to any additional Texas representative office the foreign bank seeks to establish. However, payment of the registration fee provided for in §15.2(b) of this title (relating to Filing and Investigation Fees) may not be waived.

(f) Notices. A foreign bank that maintains a representative office in this state shall file the following notices in English with the banking commissioner:

(1) the change of control notice required under the Finance Code, §204.005;

(2) notice of the closing of a representative office in this state at least 30 days before the effective date of the closing;

(3) notice of a change in location containing the street, post office and mailing address of the new location at least 30 days before the effective date of the relocation; and

(4) copies of other notices or applications filed with a federal regulator affecting the representative office in this state, at the time filed with the federal regulator.

Source: The provisions of this §3.44 adopted to be effective March 9, 2006, 31 TexReg 1643; amended to be effective July 5, 2018, 43 TexReg 4451; amended to be effective September 8, 2022, 47 TexReg 5327.

(a) A representative office established in this state by a foreign bank shall maintain the following records in English or accompanied by an English translation and make the records available for examination by the department or as otherwise requested by the banking commissioner:

(1) copies of all reports sent to the foreign bank by the representative office;

(2) copies of all policies pertaining to the solicitation, origination, and accounting of loans between the representative office and other offices of the foreign bank;

(3) a description of all activities in which the representative office is engaged and its target market;

(4) assets, liabilities, and income and expense journals for the representative office;

(5) the organizational chart of the representative office, including officer titles, functions, and reporting lines;

(6) marketing, business plans, and budgets for the representative office;

(7) copies of all lease agreements on rented office space and fixed assets in this state, including details of the sharing arrangement covering the office space if the office space is shared with another unit of the foreign bank;

(8) a copy of the most recent audited annual report of the foreign bank, in English;

(9) copies of all insurance policies covering fraud and fixed assets that relate to the representative office;

(10) a list of other operations and affiliates of the foreign bank in the United States;

(11) for all extensions of credit solicited or handled by the representative office:

(A) copies of the credit approval from the domestic agency, branch facility, or foreign bank corporation, which may authorize the representative office to sign and execute the loan contract and related documentation. The approval may be in the form of a facsimile transmission or telex from the applicable foreign bank office;

(B) complete copies of all loan agreements and all subsequent revisions and amendments; and

(C) complete copies of credit and collateral documentation, including borrowing base calculations and reports; and

(12) to the extent not identified in paragraphs (1) - (11) of this subsection, the records required under the Finance Code, §204.002; and

(13) such other records the banking commissioner may require.

(b) A representative office affiliated with a foreign bank branch or agency in this state may maintain records at the office of the foreign bank branch agency.

Source: The provisions of this §3.45 adopted to be effective September 13, 1996, 21 TexReg 8453; amended to be effective March 9, 2006, 31 TexReg 1643.

Subchapter D. Pledge and Maintenance of Assets by Foreign Bank Licensed to Maintain Texas State Branch or Agency

(a) Authority. This subchapter is adopted under the authority of Finance Code, Title 3, Subtitle G, Chapter 204, Subchapter B, particularly Finance Code, §§204.113 and 204.114. Subchapter B authorizes a foreign bank to establish and maintain a Texas state branch or agency upon receiving a license from the Texas Banking Commissioner. Section 204.113 authorizes the banking commissioner to require a foreign bank so licensed to deposit and pledge to the banking commissioner assets in Texas in an amount and subject to such conditions as may be determined or authorized by rule. Section 204.114 authorizes the banking commissioner to require a foreign bank to satisfy the ratio of Texas state branch or agency assets to liabilities as may be determined or authorized by rule.

(b) Purpose. This subchapter implements Finance Code, §§204.113 and 204.114. It establishes the amount of assets that a foreign bank subject to its provisions must deposit and pledge and the conditions related to the pledge. The subchapter also authorizes the banking commissioner to require a foreign bank to maintain a specific ratio of assets to liabilities as the banking commissioner deems necessary or desirable to address supervisory concerns.

(c) Scope. This subchapter applies to a foreign bank that is licensed to establish and maintain one or more Texas state branches or Texas state agencies under Finance Code, Title 3, Subtitle G, Chapter 204, Subchapter B, and that carries nonrelated liabilities on the books, accounts and records of such branch, branches, agency or agencies.

Source: The provisions of this §3.51 adopted to be effective November 12, 2003, 28 TexReg 9823.

Unless defined otherwise in this section, words and terms used in this subchapter that are defined in Finance Code, §31.002, have the same meanings as defined in the Finance Code. The following words and terms, when used in this subchapter, have the following meanings unless the context clearly indicates otherwise:

(1) Asset pledge - The total amount of assets a foreign bank must deposit and pledge to the banking commissioner and maintain on deposit at all times.

(2) Call Report - The FFIEC quarterly, consolidated report of assets and liabilities of United States branches and agencies of foreign banks, currently reported on FFIEC 002.

(3) Depository - An unaffiliated, FDIC-insured state or national bank in Texas, or a federal reserve bank.

(4) FFIEC - The Federal Financial Institutions Examination Council.

(5) Foreign bank - A foreign bank or foreign bank corporation, as defined in Section 1(b)(7), International Banking Act (12 USC Section 3107(7)), that is licensed under Finance Code, Chapter 204, to establish and maintain a Texas state branch or Texas state agency.

(6) ROCA - The rating system used by the Federal Reserve Board, the Office of the Comptroller of the Currency, and state banking regulatory authorities that measures risk management, operation controls, compliance and asset quality and thereby determines the condition of a foreign bank's branch or agency or commercial lending subsidiary in the United States.

(7) Texas state branch - One or more branches established and maintained in Texas by a foreign bank under a license issued pursuant to Finance Code, Chapter 204. The term also includes a foreign bank branch as referred to in subchapters B and C of this title (relating to General state bank regulations and Foreign Bank Agencies, respectively).

(8) Texas state agency - One or more agencies established and maintained in Texas by a foreign bank under a license issued pursuant to Finance Code, Chapter 204. The term also includes a foreign bank agency as referred to in subchapters B and C of this title (relating to General state bank regulations and Foreign Bank Agencies, respectively).

(9) Nonrelated deposit liabilities - The liabilities to nonrelated parties consisting of deposits and credit balances reported in the Call Report in accordance with Call Report instructions, currently reported on line 4.a. of Schedule RAL-Assets and Liabilities.

(10) Nonrelated other liabilities - The liabilities to nonrelated parties, exclusive of nonrelated deposit liabilities, reported in the Call Report in accordance with Call Report instructions, currently reported on lines 4.b-4.g. of Schedule RAL-Assets and Liabilities. Nonrelated other liabilities include federal funds purchased and sold under agreements to repurchase, other borrowed money, branch or agency liability on acceptances executed and outstanding, trading liabilities and other liabilities to nonrelated parties.

Source: The provisions of this §3.52 adopted to be effective November 12, 2003, 28 TexReg 9823; amended to be effective July 5, 2018, 43 TexReg 4451.

(a) Asset pledge required. A foreign bank that maintains and operates a Texas state branch or agency, and carries nonrelated deposit liabilities on the books and records of its Texas state branch or agency as liabilities of such branch or agency, must pledge and keep assets on deposit with a depository in accordance with this subchapter.

(b) Amount of deposit. Subject to a minimum deposit of $100,000, the amount of assets required to be deposited under subsection (a), based upon the lower of principal amount or market value, is equal to the lesser of:

(1) one percent of the average total nonrelated liabilities, consisting of nonrelated deposit liabilities and nonrelated other liabilities, for the previous calendar quarter of such branch or agency appearing on the books, accounts and records of such branch or agency; or

(2) $100 million.

(c) Pledge of assets to banking commissioner. The assets required to be deposited under this section are deemed to be pledged to the banking commissioner for the benefit of the creditors and depositors of the Texas state branch's or agency's business in this State. Notwithstanding any provision of the Uniform Commercial Code to the contrary, the banking commissioner is deemed to have a security interest in such assets. The foreign bank must ensure that the banking commissioner has a perfected, first-priority security interest in such assets under applicable law at all times.

(d) Projection of liabilities. Prior to its first Texas state branch or agency carrying nonrelated deposit liabilities on the books and records of such branch or agency, a foreign bank must deposit assets based upon such branch's or agency's projection of total nonrelated liabilities, consisting of nonrelated deposit liabilities and nonrelated other liabilities, at the end of its first year of such operations.

(e) Increase in amount of required deposit. The banking commissioner may increase the amount required to be deposited by a foreign bank under this section if necessary or desirable to:

(1) maintain the Texas state branch or agency in sound financial condition;

(2) protect the depositors, creditors and the public interest in Texas; or

(3) support public confidence in the business of the Texas state branch or agency.

Source: The provisions of this §3.53 adopted to be effective November 12, 2003, 28 TexReg 9823; amended to be effective September 8, 2022, 47 TexReg 5327.

(a) Asset pledge not generally required. Subject to subsection (b) of this section, a foreign bank that carries only nonrelated other liabilities on the books and records of its Texas state branch or agency, and does not carry nonrelated deposit liabilities, is not required to pledge assets under this subchapter.

(b) Authority of banking commissioner to require asset pledge. The banking commissioner, in his sole discretion based upon the factors identified in §3.53(e) of this title (relating to Asset Deposit and Pledge Requirement Applicable to Branch or Agency with Nonrelated Deposit Liabilities), may require a foreign bank that carries only nonrelated other liabilities on the books and records of its Texas state branch or agency to pledge assets in accordance with §3.53 of this title (relating to Asset Deposit and Pledge Requirement Applicable to Branch or Agency with Nonrelated Deposit Liabilities). In such event, the bank must comply with all provisions of this subchapter relating to the deposit and pledge of assets.

Source: The provisions of this §3.54 adopted to be effective November 12, 2003, 28 TexReg 9823.

(a) Calculation of liabilities in accordance with Call Report. For purposes of §3.53(b), and except as otherwise provided in this subchapter, a foreign bank must:

(1) calculate the nonrelated deposit liabilities and nonrelated other liabilities of its Texas state branch or agency in accordance with the instructions in the FFIEC Call Report; and

(2) calculate the asset pledge on the same basis on which it calculates quarterly averages for Call Report purposes (currently, the average of liabilities subject to asset pledge either as of the close of business for each day of the calendar quarter or as of the close of business on each Wednesday during the calendar quarter).

(b) Aggregation. A foreign bank that maintains more than one Texas state branch or agency must calculate the amount of the required asset pledge on an aggregate basis.

Source: The provisions of this §3.55 adopted to be effective November 12, 2003, 28 TexReg 9823; amended to be effective July 5, 2018, 43 TexReg 4451.

(a) Report of liabilities and pledged assets. Each foreign bank that maintains a Texas state branch or agency that carries nonrelated liabilities, consisting of nonrelated deposit liabilities and nonrelated other liabilities, on the books and records of its Texas state branch or agency as liabilities of such branch or agency, must prepare and submit to the banking commissioner, on a form prescribed by the banking commissioner, a report showing:

(1) the average total nonrelated liabilities, consisting of nonrelated deposit liabilities and nonrelated other liabilities, of its Texas state branch or agency for the previous calendar quarter, calculated in accordance with §3.55 of this title (relating to Calculation of Liabilities); and

(2) if assets are deposited and pledged for the account of the banking commissioner under §3.53 of this title (relating to Asset Deposit and Pledge Requirement Applicable to Branch or Agency with Nonrelated Deposit Liabilities), the assets deposited and pledged and the total value of such assets as of the end of the quarter for which liabilities are reported under subsection (a)(1) of this section.

(b) Authentication and submission of report. A duly authorized officer of the foreign bank must sign the report required under subsection (a) of this section and certify that the report is true and correct. The report must be submitted to the banking commissioner no later than the date the foreign bank must submit the Call Report for the end of the quarter for which the calculation is made to the appropriate Federal Reserve Bank according to Call Report instructions.

(c) Additional deposits to satisfy the pledge requirement. A foreign bank must deposit into the pledge account such additional assets as may be required, based upon the quarterly calculation, to satisfy the pledge requirement established in §3.53 of this title (relating to Asset Deposit and Pledge Requirement Applicable to Branch or Agency with Nonrelated Deposit Liabilities). The foreign bank must deposit the additional assets no later than the date on which the bank must submit the Call Report for the end of the quarter for which the calculation is made.

Source: The provisions of this §3.56 adopted to be effective November 12, 2003, 28 TexReg 9823.

The following liabilities of a foreign bank's Texas state branch or agency are not included for purposes of calculating the amount of assets required to be pledged under §3.53 of this title (relating to Asset Deposit and Pledge Requirement Applicable to Branch or Agency with Nonrelated Deposit Liabilities):

(1) amounts due and other liabilities to other offices, agencies, branches and affiliates of the foreign bank;

(2) liabilities arising from repurchase agreements and other similar instruments to the extent secured by collateral;

(3) reserves for possible loan losses and other contingencies; and

(4) such other liabilities as the banking commissioner may determine.

Source: The provisions of this §3.57 adopted to be effective November 12, 2003, 28 TexReg 9823.

(a) Eligible assets. In addition to the assets consisting of dollar deposits and investment securities described in Finance Code, §204.113(a), a foreign bank may deposit the following assets to satisfy the pledge requirement established in §3.53 of this title (relating to Asset Deposit and Pledge Requirement Applicable to Branch or Agency with Nonrelated Deposit Liabilities):

(1) reserves maintained with a federal reserve bank in or outside this state;

(2) United States and non-United States debt obligations that are rated investment grade by a recognized United States rating service; and

(3) assets specifically approved by the banking commissioner upon prior written application.

(b) Asset pledge conditions and limitations. Unless the banking commissioner specifically permits otherwise, the following conditions and limitations apply to the asset pledge:

(1) Assets must be payable in the United States and payable in United States dollars; and

(2) Assets must be capable of being promptly sold under ordinary market conditions at a fair market value determined by reliable and continuously available price quotations, based upon actual transactions on an auction or similarly available daily bid and ask price market.

(c) Authority of banking commissioner to impose additional conditions. With respect to any asset, the commissioner may determine that, for purposes of this subchapter, a foreign bank must hold such asset in such form or subject to such conditions as the banking commissioner may prescribe. The banking commissioner may expressly disallow one or more otherwise eligible assets, either for all foreign banks or a specific foreign bank. All assets are subject to any additional conditions or limitations deemed by the banking commissioner to be necessary or desirable.

Source: The provisions of this §3.58 adopted to be effective November 12, 2003, 28 TexReg 9823.

(a) Approved deposit agreement. A foreign bank and a depository must execute a deposit agreement approved by the banking commissioner before the foreign bank may deposit assets for purposes of Finance Code, §204.113, and this subchapter. In addition to any other terms and conditions that are not inconsistent with those listed in this section or imposed by the banking commissioner, the deposit agreement must include the terms and conditions set forth in subsections (b) through (m) of this section.

(b) Limitation on assets that may be deposited. Only assets eligible to be pledged under §3.58 of this title (relating to Eligible Assets and Conditions) may be deposited into the pledge account.

(c) Assets pledged to banking commissioner. The assets must be pledged to the banking commissioner for the benefit of the creditors and depositors of the Texas state branch's or agency's business in this State. The banking commissioner must be provided with, and is deemed to have, a security interest in the pledged assets.

(d) Assets held as special deposit. The depository must hold the assets deposited under the agreement as a special deposit free of any lien, charge, right of set-off, credit, or preference in connection with any claim of the depository against the foreign bank or the Texas state branch or agency. The depository may not accept any asset under the agreement that is not accompanied by documentation necessary to facilitate transfer of title.

(e) Depository to furnish receipt. The depository must furnish the foreign bank, upon the deposit of assets under the depository agreement, a receipt or statement as evidence of the deposit. The receipt or statement must identify the deposit as having been made pursuant to Finance Code, §204.113, and under the deposit agreement, and must state the amount of the deposit and, with respect to the deposit of securities, a description of each security deposited.

(f) Release of securities by depository. The depository must release deposited assets to the foreign bank upon written request:

(1) when accompanied by a certificate, as described in subsection (g) of this section, signed by a duly authorized officer of the foreign bank; or

(2) upon receipt of the banking commissioner's written order to release such part of the deposited assets under such conditions and terms as the order may specify.

(g) Model certificate. A duly authorized officer of the foreign bank must execute the following or a similar certificate before making a withdrawal under subsection (f)(1) of this section:

It is hereby certified that the aggregate value of securities and/or funds remaining on deposit pursuant to the Deposit Agreement after this withdrawal or substitution amounts to $_________, valued at the lower of principal amount or market value, and that such amount is at least equal to the amount required to be deposited under Finance Code, §204.113, and 7 TAC §3.51 et seq. The amount required to be maintained on deposit, calculated in accordance with this subchapter, is $____________ as of this date.

(h) Depository to furnish monthly statement of all transactions. The depository must furnish to the foreign bank, at least once in each calendar month, a statement of all transactions in the pledge account since the closing date of the previous statement. The statement must include a listing of the securities and/or the amount of funds on deposit as of the closing date of the statement. The depository must simultaneously send a copy of the statement to the banking commissioner.

(i) Depository may pay interest. So long as the Texas state branch or agency continues business in the ordinary course, the depository may pay interest earned on the assets in the pledge account in accordance with such arrangements as may be made between the depository and the foreign bank.

(j) Responsibility of depository with respect to deposited securities. Except as provided in this subsection, a depository must hold securities deposited under the deposit agreement separate and apart from all other securities and must permit duly authorized representatives of the foreign bank or of the banking commissioner to examine and compare such securities. A depository may utilize a central depository, clearing corporation or book entry system to hold securities deposited under the deposit agreement, provided that the records of the central depository, clearing corporation or book entry system show that the depository holds the securities as principal or as agent or as custodian of its customers. The depository must maintain adequate records to demonstrate the disposition of any book entry deposits.

(k) Safeguarding of deposited securities. The depository must give the same degree of care to the safekeeping, handling and shipping of deposited securities that the depository would give to its own securities.